With the Bank of Canada's meeting on October 23, 2024, just around the corner, Canadians are watching interest rates closely. A new survey shows that 74% of Canadians considering buying or refinancing need policy rates to drop below 3% before they act. The data paints a picture of a nation divided-some are holding out for better rates, while others are ready to move forward, no matter what.

"We knew Canadians wanted lower rates, we knew Canadians wanted into the housing market, we just didn't know how low they needed rates to go before they get off of the sidelines," says Andy Hill, Mortgage Broker and Co-Founder of EveryRate.ca. "Most Canadians are clearly waiting for rates to drop further before moving. Given the current rate trend, we might not see policy rates below 3% until late 2025. That means many potential buyers and refinancers will likely stay on the sidelines for the foreseeable future."

What Will It Take for Canadians to Enter the Housing Market?

With the Bank of Canada's policy rate at 4.25% and a potential 0.50% cut on the horizon, understanding the motivations of buyers and refinancers is key to predicting market shifts.

We asked: "How low would the Bank of Canada policy rate need to be to motivate you to buy a home or refinance your current mortgage?"

How Low Do Rates Need to Go?

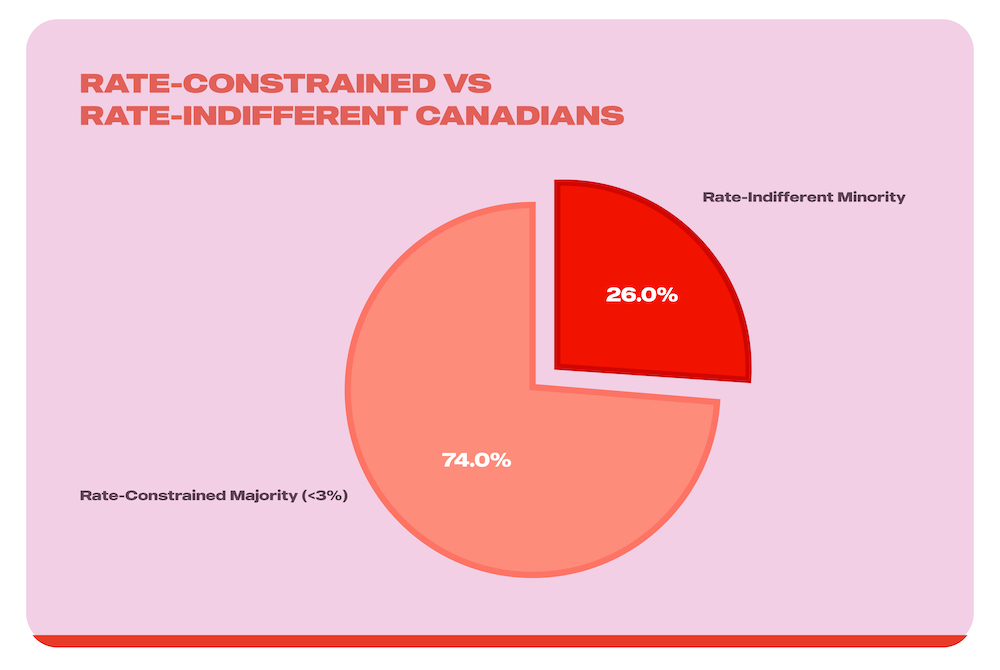

Among survey participants actively considering buying or refinancing, two distinct groups emerged based on how much interest rates needed to drop to prompt action:

Group 1: The Rate-Constrained Majority

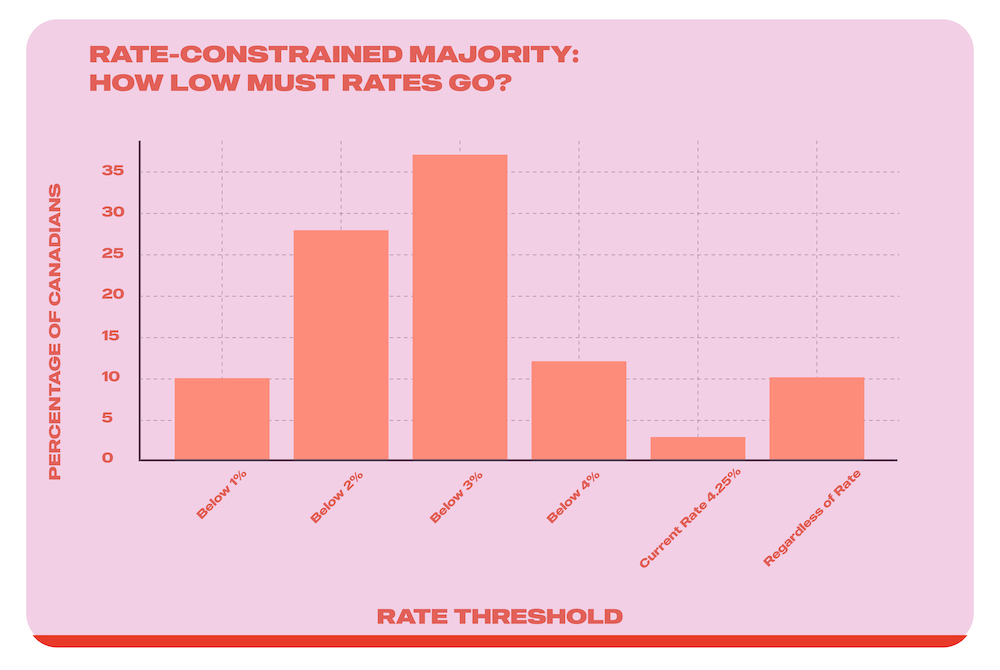

This group needs significant rate cuts to make a move:

- 10% would act if the policy rate dropped below 1%.

- 28% would act if the policy rate falls less than 2%.

- 37% would act if the policy rate falls less than 3%.

- 12% would act if the policy rate dropped below 4%.

Group 2: The Rate-Indifferent Minority

This group is less affected by rate changes:

- 3% would act if rates stayed between 4% and 4.25% (the current rate).

- 10% said they would buy or refinance regardless of the interest rate.

The Rate-Constrained Majority

74% of respondents need the policy rate to fall below 3% before they take action. Younger Canadians (18-34 years old) are especially prevalent in this group, with many needing rates below 2% or even below 1% to consider buying or refinancing.

For many, higher monthly payments tied to elevated interest rates are unaffordable. High housing costs and stagnant income growth add to the pressure. Rates below 3% aren't just preferable-they're essential to making homeownership possible for this group.

Without significant changes-either through meaningful rate drops or better affordability measures-this group is likely to remain on the sidelines of home ownership and refinancing.

The Rate-Indifferent Minority

In contrast, 26% of respondents would buy or refinance regardless of interest rates. This group mainly includes older Canadians (55+), who are less affected by rate fluctuations. Their decisions are driven by lifestyle changes, downsizing, or helping family members enter the market.

Our earlier survey reflected this trend, with 16% of those aged 65+ indicating they would act regardless of rates. Their financial stability sharply contrasts the younger, rate-sensitive group, highlighting a generational divide in deciding factors to purchase or refinance a home.

Generational Divide: Younger vs. Older Canadians

Due to financial constraints, younger Canadians are highly sensitive to interest rate changes, while older Canadians have the financial flexibility to act independently of rate changes.

High borrowing costs, stagnant wages, and existing financial burdens like student loans make current rates challenging for younger people. Older generations, often having bought homes when prices were lower and rates were better, are in a better position to make moves now.

While rate cuts may encourage some younger buyers, they are unlikely to lead to significant activity among financially secure older homeowners. Younger Canadians often need more assistance to enter the housing market, while older Canadians are more comfortable regardless of the rate environment. Solutions must go beyond rate cuts to see a real boost in market activity. Policies to improve housing affordability could help bridge the gap and make the market more accessible for first-time buyers.

Conclusion: What Lies Ahead for Canadian Housing?

The survey results show a divide in rate sensitivity among Canadians considering buying or refinancing. While 74% are waiting for rates to drop below 3%, only 10% are ready to act regardless of rates a split mainly along generational lines.

With the Bank of Canada's upcoming meeting on October 23, 2024, a potential 0.50% rate cut to 3.75% is expected. If the Bank of Canada continues to cut rates by 0.25% at each future meeting, the policy rate could fall below 3% by the second half of 2025.

However, early estimates suggest rates might not dip below that mark. This explains why many Canadians remain on the sidelines-waiting for a rate environment that may not come soon.

Drawing from current and past surveys, many Canadians aren't ready to make a move-not because they don't want to, but because of unfavourable conditions. More significant rate cuts or broader affordability measures are needed to encourage activity. For younger Canadians, the need for accessible entry points into the market is clear.

While the Bank of Canada's rate decisions may prompt some movement, the broader market will likely stay static without extra support. Understanding these distinct groups and their motivations helps us predict when Canadians might finally re-enter the real estate market.

About the Survey: Leger conducted this online survey for EveryRate.ca between September 27 - 30, 2024, with 1,626 Canadian adults participating. The data was weighted to reflect the Canadian population based on 2021 Census figures. While it's a non-probability sample, a comparable probability sample would have a margin of error of 2.4%, 19 times out of 20.

Other popular articles: Questions You Must Ask Your Mortgage Broker Before Refinancing | Fixed vs. Variable-Rate Mortgages: Which is Right for You? | Mortgage Refinancing for Retirees: What You Need to Know | The No-Nonsense Guide to Mortgage Refinancing in Canada | Personal Line of Credit vs Home Equity Loan vs HELOC: How to Choose | Common Questions About the Canadian RRSP HBP Mortgage Rates in Vancouver | Mortgage Rates in Victoria | Mortgage Rates in BC | Mortgage Rates in Ontario | Mortgage Rates in Richmond | Mortgage Rates in Surrey | Mortgage Rates in Burnaby | Mortgage Rates in Delta | Mortgage Rates in Abbotsford | Mortgage Rates in Kelowna | Mortgage Rates in Nanaimo | Mortgage Rates in Saskatchewan