As housing costs rise nationwide, many Canadian households are nearing a financial breaking point. A recent survey reveals that more than half of Canadians could only sustain a 15% increase in housing costs for less than six months before having to make drastic changes, like moving or selling their homes. By focusing on a 15% increase—a realistic figure given trends in rent, mortgage payments, and property taxes—the survey highlights stark disparities in financial preparedness and the urgent need for proactive planning.

With rising property taxes, inflation, and looming mortgage renewals, 2025 is shaping up to be a pivotal year for household budgets.

"Now, more than ever, Canadians need to prepare for financial uncertainty," says Andy Hill, a financial expert specializing in housing affordability. "It’s not just about cutting costs but taking proactive steps—like getting multiple mortgage quotes and exploring all your options—to safeguard your finances."

Survey Highlights: How Long Can Canadians Hold On?

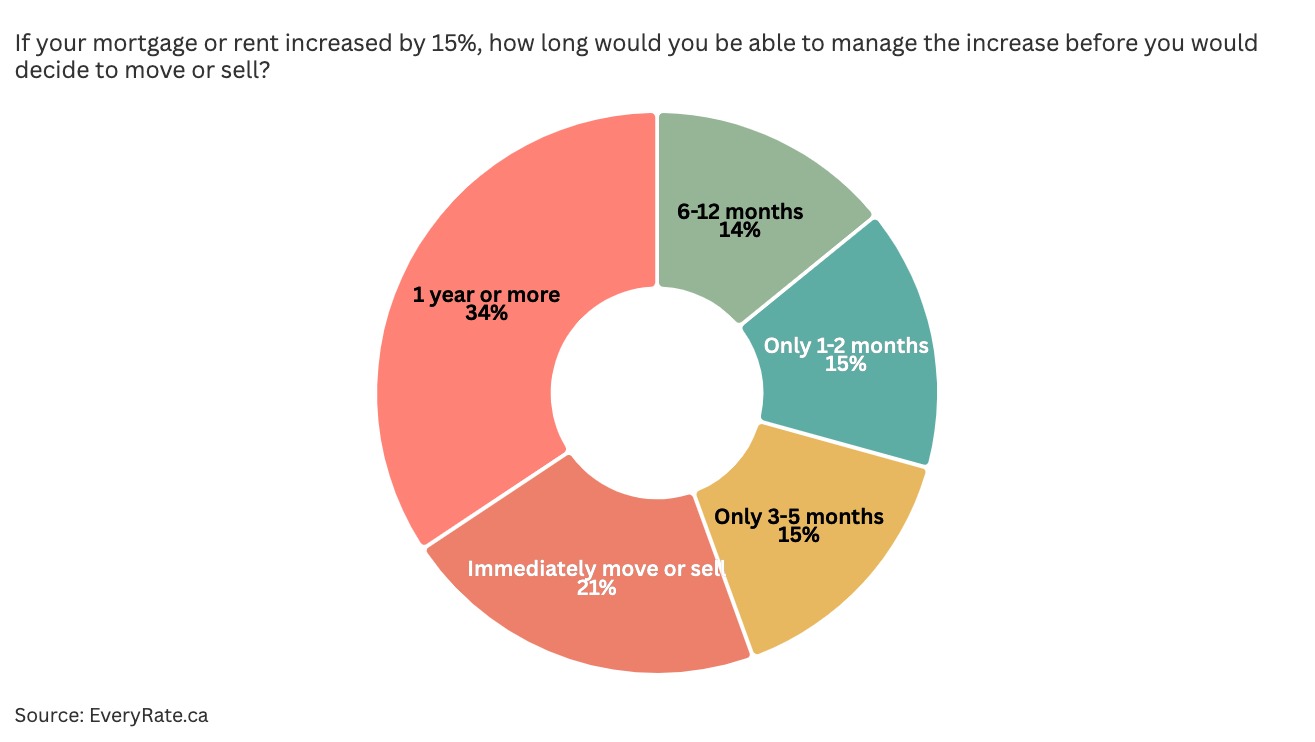

The survey, conducted by Leger for EveryRate.ca in November 2024, asked Canadians: "If your mortgage or rent increased by 15%, how long would you be able to manage the increase before deciding to move or sell?"

The responses paint a picture of financial vulnerability:

- 62% of younger Canadians (18–24) could sustain less than six months of higher housing costs, with similar results for those aged 25–34 (63%).

- 66% of low-income households (earning under $60,000 annually) couldn’t sustain a 15% cost increase for more than six months.

- 63% of renters said they couldn’t manage a 15% increase for six months, compared to 44% of homeowners.

- 60% of families with children said they were unable to manage increased costs, compared to 48% of households without children.

- 60% of BIPOC respondents reported they couldn’t sustain a cost increase beyond six months, compared to 49% of white respondents.

What Does a 15% Increase Look Like?

While a 15% increase might not sound substantial, the numbers tell a different story. For many Canadians, paying even a few hundred extra dollars each month could mean they go without some essentials or lead to them reconfiguring their living situation entirely.

This isn’t the first time we’ve seen how closely tied housing costs are to financial stability. In a related survey, 67% of Canadian households reported they can’t comfortably afford housing costs over $1,749 per month. Even higher-income households indicated financial strain, highlighting the widespread challenge of rising costs.

For Homeowners: Rising Mortgage and Tax Payments

For an average Canadian homeowner with a $2,000 monthly mortgage, a 15% increase would add $300, bringing the total to $2,300. Pair this with rising property taxes and the financial burden grows even heavier.

For Renters: Rental Increases and the Threat of Housing Insecurity

Renters face a similar squeeze. With the average rent for a two-bedroom apartment in Canada at $1,800, a 15% increase would add $270, raising the total to $2,070. For those already allocating a significant share of their income to housing, this could mean reevaluating their living arrangements, or worse, facing housing insecurity.

Other Factors Driving Costs in 2025

Considering the financial realities of a 15% increase may not be as far-fetched as it seems. Here’s why:

Mortgage Renewal Shock: More than 1.2 million fixed-rate mortgages will renew in 2025, according to Canadian Mortgage and Housing Corporation (CMHC). Many were locked in at rates below 2%. Renewing at today’s rates of 3.5% to 4.5% could mean $200–$300 monthly payment increases for homeowners.

Stubbornly High Interest Rates: While variable rates are beginning to decline, they remain significantly higher than they were four years ago. Fixed rates are holding steady or trending upward, adding challenges for renewals or new mortgages.

Property Taxes Rising Nationwide: Municipalities across Canada are raising property taxes to address budget deficits. For example, Toronto’s 9.5% increase for 2024 adds $380 annually—or $32 per month—to a $4,000 property tax bill.

These pressures make financial preparedness essential as households brace for higher costs in the coming year.

What Can Canadians Do to Prepare?

Navigating financial uncertainty doesn’t have to lead to financial instability. Here are some steps Canadians can take to proactively address rising housing costs:

- Talk to a Mortgage Broker: Comparing multiple quotes could save you thousands of dollars over the life of your mortgage. Platforms like EveryRate.ca make it simple to explore competitive rates.

- Explore Your Options: If you’re renewing a mortgage, consider locking in rates early or extending your amortization period to reduce monthly payments.

With the right resources and planning, Canadians can face these challenges head-on. As 2025 approaches, taking steps now could ease the financial strain and build confidence for the future.

About the Survey - This survey was conducted online by Leger using its Canadian omnibus platform on behalf of EveryRate.ca. Fieldwork took place between November 15 and 18, 2024, with 1,526 Canadian adults aged 18 and older completing the survey.

The sample was statistically weighted to reflect the Canadian population according to the 2021 Census of Canada figures. While the sample is a non-probability panel survey, for comparison purposes, a probability sample of this size would have a margin of error of ±2.5%, 19 times out of 20.

Other popular articles: Questions You Must Ask Your Mortgage Broker Before Refinancing | Fixed vs. Variable-Rate Mortgages: Which is Right for You? | Mortgage Refinancing for Retirees: What You Need to Know | The No-Nonsense Guide to Mortgage Refinancing in Canada | Personal Line of Credit vs Home Equity Loan vs HELOC: How to Choose | Common Questions About the Canadian RRSP HBP