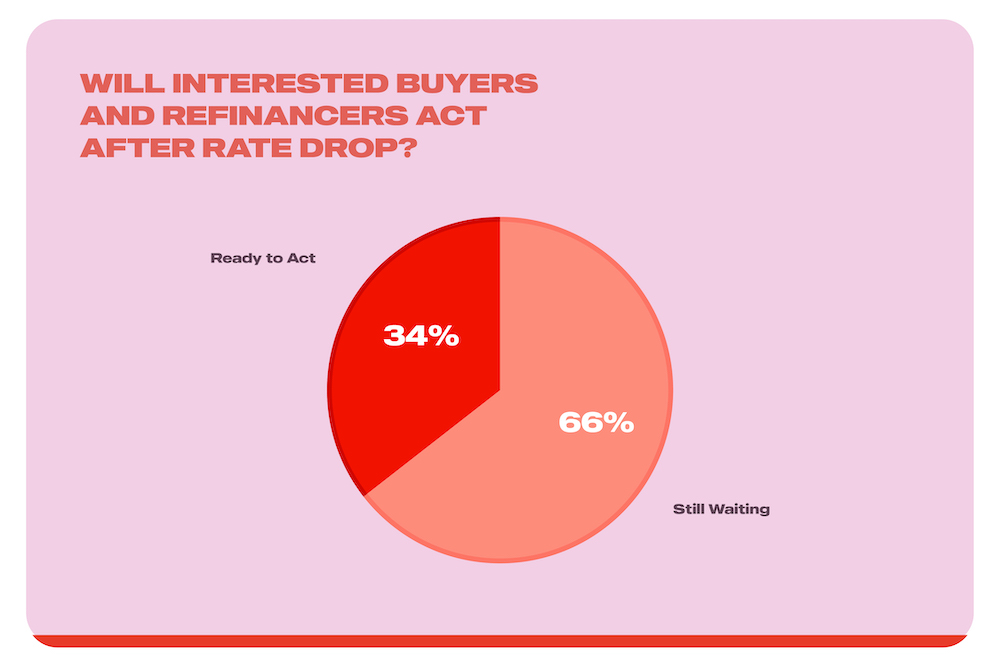

Despite their interest in doing so, 66% of Canadians considering buying a home or refinancing say a potential rate decrease in October won't result in them taking action within the next 90 days. As the Bank of Canada's rate announcement approaches, our survey illuminates the timing and motivations influencing the decisions of both potential and existing home buyers.

"While it's promising that a segment of Canadians are poised to act on upcoming rate drops, the reality is that over two-thirds are still waiting on the sidelines," says Andy Hill, Mortgage Broker and co-founder of EveryRate.ca. "This tells us that minor rate adjustments aren't enough. Canadians are looking for more substantial changes before they feel confident to jump into the market. At EveryRate.ca, we're dedicated to empowering consumers with the information they need to make informed decisions, whether they're ready to make a move now or waiting for the right moment."

When Canadians Might Step Off The Sidelines

To understand when Canadians might consider re-entering the real estate market, we asked them directly: "How, if at all, would a further Bank of Canada interest rate drop on October 23rd affect your likelihood of buying or refinancing your home in the next 90 days?"

Recognizing that interest rates are a major factor in financial decision-making, our goal was to capture real insights into how these rate changes could impact Canadians' readiness to take action.

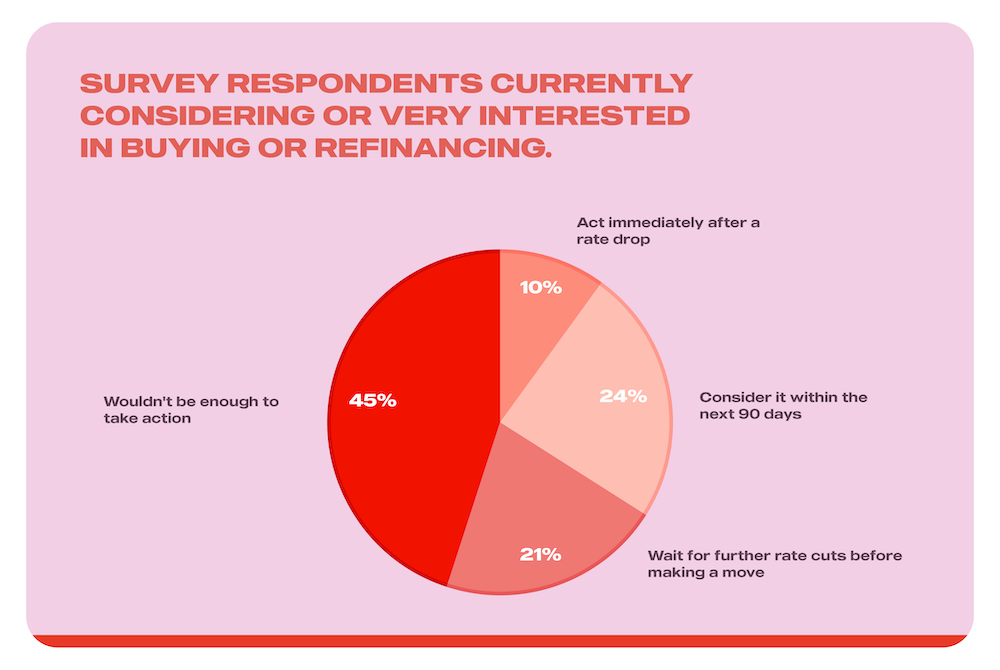

We focused on the 47% of survey respondents who are "currently considering" or "very interested" in buying or mortgage refinancing, excluding the 53% who have no plans to do so and indicated that this did not apply to them at this time.

- Within the 47% "very interested" group:

- 10% would buy or refinance immediately after a rate drop.

- 24% would consider buying or refinancing within the next 90 days.

- 21% would wait for further rate cuts before making a move.

- 45% said rate changes wouldn't impact their plans at this time.

Of this group, 34% are likely to act within the next 90 days, but 66% are hesitant and unlikely to act soon.

Two Distinct Groups: Hesitant vs. Ready to Move

Our findings highlight a split between two groups: the 66% who are unlikely act in the next 90 days, and the 34% who are ready to move soon on current or upcoming rate cuts. This indicates when Canadians are likely to step back into the market.

Group 1: The 66% Waiting for Bigger Rate Drops

This group is very interested but not ready to take action with October rate changes, requiring larger rate cuts before making a move. This shows that many Canadians will stay on the sidelines until there's a significant rate reduction.

- Highlights:

- Older Canadians (55+) are more likely to say a rate drop wouldn't affect their plans.

- Lower-income households need larger rate cuts before making a move.

- Residents of Manitoba and Saskatchewan are more likely to wait for bigger rate cuts.

Group 2: The Ready 34% Poised to Act on Rate Drops

This group is prepared to take action with upcoming rate cuts. They're closely watching interest rates and are ready to act quickly. This suggests even modest rate cuts could spark activity in the housing market for this group.

- Highlights:

- Younger Canadians (18-34), especially first-time buyers, are eager to enter the market.

- Higher-income households ($100K+) can quickly take advantage of lower rates.

- Alberta residents show the highest urgency, with many ready to act immediately if rates drop.

- 27% of Ontario residents would likely act within the next 90 days.

Conclusion: Many Canadians Still Hesitant but Ready to Act with the Right Conditions

Our survey reveals a clear divide among Canadians' eagerness to take action when buying or refinancing homes after the upcoming Bank of Canada rate cut. While 34% of interested respondents are likely to act within the next 90 days, 66% remain hesitant despite their high level of interest.

Many of these individuals are still on the sidelines because current conditions aren't favourable enough for them to take action. More significant rate cuts or supportive policy changes are needed to bring them back into the market and drive economic activity.

Conversely, a motivated segment of younger, higher-income Canadians, particularly in Alberta, is ready to act on current or upcoming rate drops. They are prepared to move when market conditions meet their expectations.

While the October Bank of Canada's rate decision might spur some activity, we likely won't see a significant surge of buyers or refinancers until rates drop further or broader economic factors improve. Understanding these distinct groups helps us predict when Canadians might finally return to the real estate market.

About the Survey: Leger conducted this online survey for EveryRate.ca from September 27-30, 2024, with 1,626 Canadian adults participating. The data was weighted to reflect the Canadian population based on 2021 Census figures. While it's a non-probability sample, a comparable probability sample would have a margin of error of ±2.4%, 19 times out of 20.Other popular articles: Questions You Must Ask Your Mortgage Broker Before Refinancing | Fixed vs. Variable-Rate Mortgages: Which is Right for You? | Mortgage Refinancing for Retirees: What You Need to Know | The No-Nonsense Guide to Mortgage Refinancing in Canada | Personal Line of Credit vs Home Equity Loan vs HELOC: How to Choose | Common Questions About the Canadian RRSP HBP