Mortgages are often the largest financial commitment most Canadians make. Yet, new survey data from EveryRate.ca reveals a surprising reality: nearly half of mortgage holders might be missing out on better deals by not shopping around.

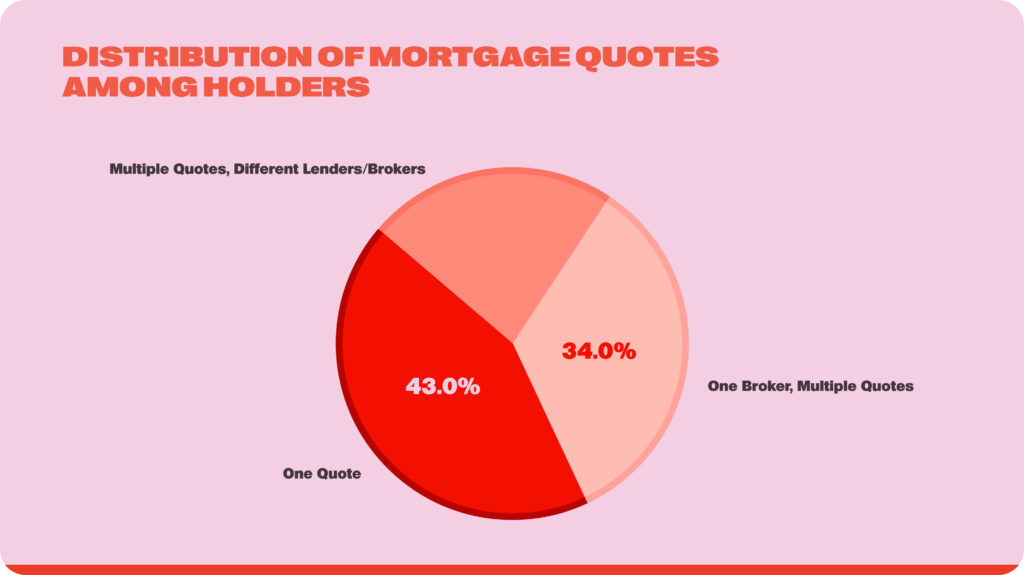

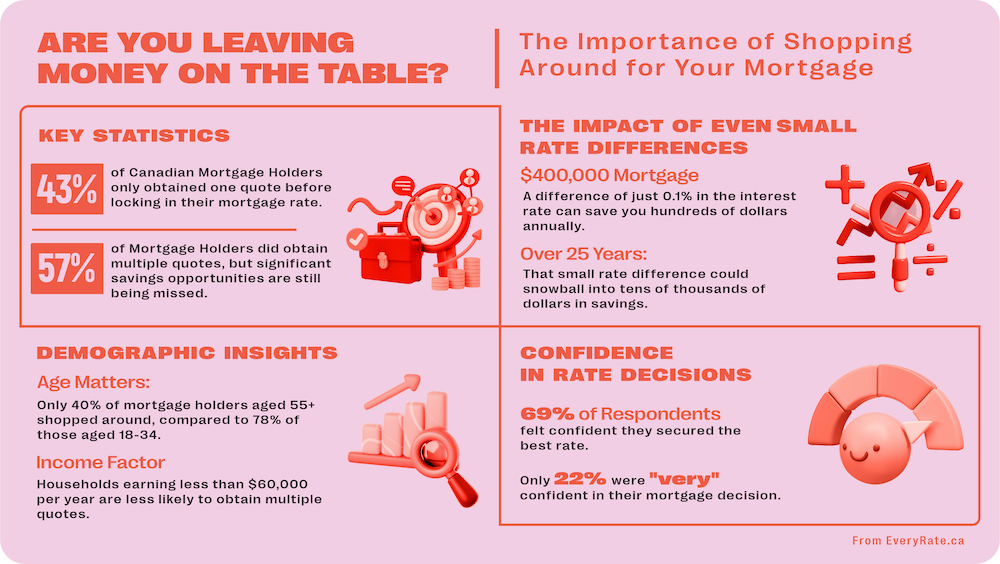

According to the survey, 43% of mortgage holders obtained just one quote before securing their mortgage rate. That's a significant oversight, especially since even a small difference in rates can have a large impact over time.

Consider this: a difference of just 0.1% in your mortgage rate might seem minor, but on a typical $400,000 mortgage, it could save you hundreds of dollars every year. Over a 25-year term, that small difference could add up to tens of thousands of dollars. This isn't just about saving a few dollarsit's about making a choice that could significantly impact your financial future.

These findings underscore the importance of comparison shopping. When it comes to securing a mortgage, taking the time to explore your options isn't just wise it's essential. Yet, many Canadians may be missing out on savings by not fully exploring their options.

Key Takeaways

- 43% of mortgage holders only obtained one quote before securing their mortgage rate.

- Mortgage holders aged 55 and older, as well as those from lower-income households, are particularly at risk of missing out on better deals.

- 69% of respondents felt "confident" they secured the best rate, but only 22% were "very confident."

Lack of Comparison Shopping Among Mortgage Holders

With 43% of mortgage holders seeking one quote before finalizing their rate, it raises the questionwhy aren't more Canadians doing their homework?

Confidence in mortgage decisions doesn't always tell the whole story. While 69% of respondents expressed confidence that they secured the best rate, only 22% felt "very confident" about their choice. This gap suggests that while many homeowners feel somewhat assured in their decisions, nearly half may still be uncertain about whether they truly got the best deal.

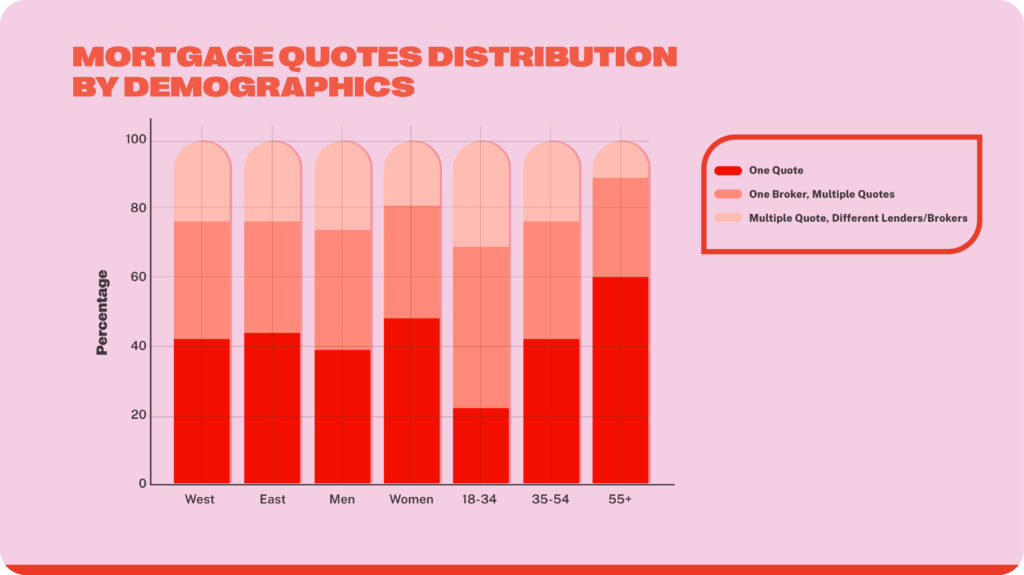

Certain groups may be at a higher risk of missing out on better rates. For instance, only 40% of mortgage holders aged 55 and older sought multiple quotes, compared to 58% of those aged 35-54, and 78% of those aged 18-34. Additionally, households with incomes below $60,000 are less likely to shop around, putting them at greater risk of securing less favourable mortgage rates.

Provincial Differences in Mortgage Shopping Habits

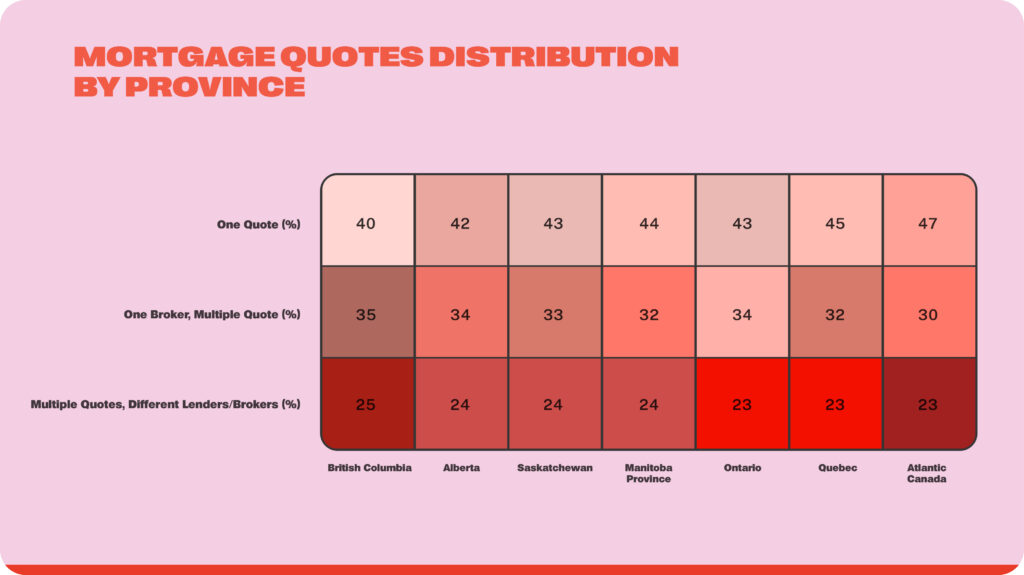

Survey findings also revealed some differences in mortgage shopping habits across Canada:

- British Columbia: Mortgage holders in B.C. are among the most proactive, with 60% getting quotes from more than one source. This might be a result of the competitive housing market in the province.

- Alberta: 58% of Albertans obtained multiple quotes, while 42% relied on just one quote.

- Ontario: In Ontario, 57% of mortgage holders sought multiple quotes, but 43% obtained only one quote.

- Quebec: Quebecers were somewhat less likely to shop around than people from other regions, with 54% getting multiple quotes. In the province, 45% of mortgage holders obtained just one quote.

- Atlantic Canada: Mortgage holders in Atlantic Canada were the least likely to shop around, with only 50% obtaining multiple quotes.

These regional differences may highlight varying levels of financial literacy and access to resources. It is evident that some provinces could benefit from targeted efforts to encourage mortgage comparison shopping.

The Hidden Cost of Not Shopping Around

Although small differences in interest rates can lead to substantial long-term savings, many Canadians do not take the time to shop around. The mortgage process can be daunting, and comparing rates might seem like an overwhelming task. However, failing to explore your options can result in significant missed opportunities for savings.

Right now, the mortgage market is more competitive than ever. Rob McLister recently wrote in the Financial Post that we're in the middle of a "rates war." Banks are "offering surprisingly low mortgage rates" to keep and attract customers. However, these deals aren't always advertised. This means you could easily miss out on lower rates if you're not actively shopping around.

This competition among lenders can be highly advantageous for consumers, especially those who take time to negotiate. In today's market, mortgage lenders are eager to keep customers and are often willing to match or even beat competing offers. Now is an ideal time to secure a better rate on your mortgage. This competitive environment means that actively seeking out and comparing offers can lead to substantial savings.

Understanding the financial impact of a mortgage rate isn't just about your monthly payments, it's about how those payments add up over time. Securing a great rate rather than a good rate could be the difference between financial ease and added stress.

The good news is that this gap in comparison shopping can be fixed. With the right tools and a little effort, Canadians can ensure they're not just securing a mortgage, but obtaining the best possible deal.

Conclusion

The findings of this survey make it clear that shopping around for mortgages is crucial because even small differences in rates can lead to significant long-term savings. While the process can seem daunting, the potential savings and increased financial security make it worth the effort. Tools like EveryRate.ca can simplify this process, helping consumers compare multiple quotes and secure the best possible rate.

Consumers are already diligent shoppers in many areas:

- 78% of buyers visit online automotive marketplaces an average of 15 times before making a final purchase decision (Trader.ca, 2023).

- 81% of retail shoppers conduct online research before making a purchase (GE Capital Retail Bank, 2017).

- 82% of shoppers consult their smartphones while in-store to inform their buying decisions (Bazaarvoice, 2018).

We need to bring that same level of scrutiny to mortgage decisions, where the stakes are much higher.

As the mortgage industry continues to evolve, using tools and technologies to make comparison shopping straightforward and accessible will be essential. It's time to empower consumers to apply the same savvy shopping practices they use for retail and automotive purchases to their mortgages, ensuring they don't miss out on potential savings.

Methodology

These results are based on an online survey using a representative sample of 848 adult Canadian homeowners with a mortgage, conducted using Leger's panel from August 16-19, 2024. As a non-random internet survey, a margin of error is not reported. For reference, a probability sample of n=848 would have a margin of error of 3.4 percentage points, 19 times out of 20. Any discrepancies between totals are due to rounding.

Other popular articles: Questions You Must Ask Your Mortgage Broker Before Refinancing | Fixed vs. Variable-Rate Mortgages: Which is Right for You? | Mortgage Refinancing for Retirees: What You Need to Know | The No-Nonsense Guide to Mortgage Refinancing in Canada | Personal Line of Credit vs Home Equity Loan vs HELOC: How to Choose | Common Questions About the Canadian RRSP HBP